Getting loan offers, sometimes, can be complicated as the terms and requirements of the loan themselves. It is for this reason you should seek to understand the requirements of loans with no credit check and cash advances payday loans before you commit to the transaction. In the section that follows, you will appreciate and understand the definition and requirements of the aforementioned types of loans.

Getting loan offers, sometimes, can be complicated as the terms and requirements of the loan themselves. It is for this reason you should seek to understand the requirements of loans with no credit check and cash advances payday loans before you commit to the transaction. In the section that follows, you will appreciate and understand the definition and requirements of the aforementioned types of loans.

Cash advances payday loans

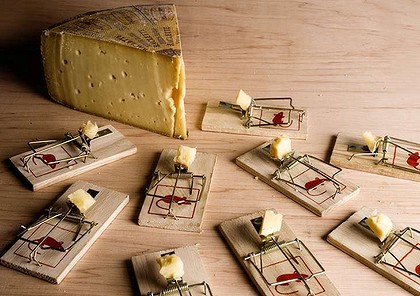

Payday loans are also known as payday mortgages. Usually, they are unsecured loans that attract high interest costs when making repayments. Cash advances payday loans are a form of no credit check loan where the lender, also known as payday lender, advances the borrowed cash with additional fee. Such loans are usually borrowed for a short time and therefore, require the borrower to make investments in fast, high income generating projects that can guarantee repayment of the borrowed cash. Whenever the loan repayments are not made in time, they are rolled over thus increasing the liability of the borrower.

The most common features of cash advances payday loans are that the amounts advanced are usually low. It is common among workers in most organizations where they become due during the next payday. Borrowers are usually required to provide access to their checking account to the lenders. Whenever repayment is due they should deposit or appropriately make repayments for the money owed.

Borrowers would apply for cash advances to make good their previous borrowings. You can always sign membership to payday loan consolidation programs that can help you deal with your payday loan debt. It is a program for loan debt collaborators whose services you can take advantage of and enjoy in the process. Either way, you should get your loan from reputable institutions and check the applicable laws in your state.

Loans with no credit check

Loans with no credit checks are the ones allow applicants for the loan to get the requested loan without the lender combing through their credit history and using it as a basis for evaluating the qualification of the applicant. In the US, so long as you have a checking account and are not a minor, you can qualify for such a loan. However, you need to familiarize yourself and agree with the terms of the loan. Persons with less than perfect credit ratings can find this opportunity beneficial so long as they invest in profitable projects that guarantee repayments of the borrowed cash. Permanent residency and citizenship are other requirements for qualification for the loans. Equally, if you have been employed for at least one year, you can also qualify for the loan.

Summary

In summary therefore, you should understand or seek to understand the requirements and qualifications for the loans of your interest. Important also is to check with the applicable law in your state and seek loans from reputable institutions.